PayPal for freelancers – Accept international payments online

The Internet has turned the world into a global marketplace. People now sell goods and services across the borders and with that, the options to accept international payments are growing.

While the businesses have a whole team of accountants and advisors, individuals don’t enjoy such privileges. So, most are left bewildered or feel overwhelmed with the different ways available. PayPal, however, remains the choicest method for many (including me). But how to accept international payments on PayPal?

Well, here’s everything about PayPal for individuals – benefits, process and the charges involved.

What is PayPal?

Founded in December 1998 as a security software company – Confinity – PayPal (since 1999) is a trusted service to accept international payments online. And its services are available worldwide, in more than 200 countries around the world.

To receive international payments, PayPal supports more than 100 currencies. Even Indian Rupee (INR) is available, however, only for local payments (transactions to and from Indian accounts).

PayPal allows businesses and individuals to accept payments from abroad, and the transactions happen instantly (well, almost). And all it requires is your email address.

Why to accept international payments through PayPal?

PayPal is the best way to accept international payments in India, and reliability is only one of the reasons. There’s more to it.

- It’s available worldwide in 200+ countries and supports 100+ currencies for transactions.

- You can use PayPal to invoice your clients directly for your services. They can then, pay the amount using the associated link.

- Although PayPal can’t keep any amount with itself in India, you can still use the linked debit/credit cards for shopping and recurring payments.

- Transactions within PayPal accounts take place immediately, irrespective of date, time and location.

- PayPal is free to use. It charges only when you receive payments. (Details provided below)

And those were the key reasons why people consider it as the best way to accept international payments online.

What are the documents required for a PayPal account?

Before you start accepting international payments through PayPal, you’ll need to verify your account. And that includes your email address, PAN card and local bank account. Then you also need to select the default purpose code for payments. (Talking about it in the next section)

Once the profile is complete, PayPal will make two small transfers to your bank account in the next 3-5 days. In the meantime, upload your PAN card and verify your email address. When the transferred amounts reflect in your bank account, log into PayPal and enter those amounts to complete the verification.

You are then ready to accept international payments in India. Check this article on Shout Me Loud for the setup process in detail – How to create PayPal account in India?

However, to accept local payments (within India) through PayPal, you’ll need to upload a few more documents –

- Proof of Identity – PAN card will suffice.

- Proof of Address – Passport, Voter ID card, Driving License, and Aadhaar Card are among the valid documents. Check PayPal’s KYC page for the complete list.

- Proof of Bank – Bank statements or passbook will do, or you can upload a void cheque.

Those were the documents required for individuals to use PayPal. Once you upload them, it will start the verification process (which took only 24 hours in my case). You can still use PayPal to accept overseas payments while verification is pending.

What is the PayPal purpose code?

Pretty self-explanatory, the purpose code is there to tell PayPal the purpose of the payments you receive. It varies according to the services you provide but remains the same whether you are a full-time employee, business or freelancer.

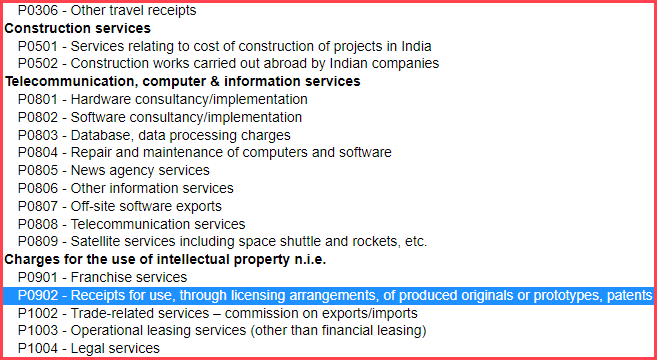

For example, I use the purpose code 0902 (Receipts for use, through licensing arrangements, of produced originals or prototypes, patents). Why?

Well, I sell the license to use the content I write for people and thus, get paid in return. Apart from writing, I also earn through my clicked photographs and P0902 suits that purpose too. Graphic designers also, probably, can choose it as their default.

Additional read - 5 Content Writing Tools to Save the World

In general, freelance writers can go for P0806, marketers can select P1007 and data managers can use P0803. Virtual assistants can use P0808, and if you’re an accountant, select P1005.

There are various purpose codes available for the IT field, legal consultancy and different other services. Pick the one which suits the nature of the service(s) you provide. By the way, you can change the purpose code anytime by accessing the Settings page.

How much does PayPal charge for transactions?

As mentioned above, you can use PayPal for free. You will pay only when you get paid; there are no other charges. But how much should you expect to pay when you receive payments through PayPal?

Well, there are three things involved – transaction charge, service charge and the exchange rate. Although the transaction charge for various currencies is listed in the PayPal Seller Fees page, other charges vary. And the short answer is, you will lose around 8-9% of the amount you receive as international payments.

Let’s calculate using an example.

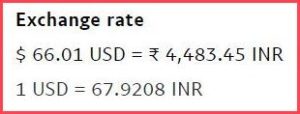

As you can see in the screenshot alongside, the client sent me $70, but I received only $66.01. PayPal kept $3.99 as its fee. And the calculation goes like this –

i) Transaction charge (= 4.4% of the payment + $0.30) –

4.4% of $70 is $3.08. Add $0.30 to it, and the total transaction charge that you pay is $3.38 for receiving $70 in your PayPal.

ii) Service charge (=18% of the transaction charge) –

Now, 18% of transaction charge of $3.38 is $0.61. So, the total fee that PayPal charges you for $70 payment is $3.99 (= 3.38 + 0.61).

Then comes the exchange rate into play, which varies every day. But the PayPal exchange rates are about 3-4% lower than the actual exchange rates.

In the attached screenshot, which is the actual amount I received in my bank account, PayPal quoted 1 USD as 67.92 INR. But on that day, the value hovered around 70.35 INR.

Now if you do the maths, $70 should amount to ₹4,924.5 (1 USD = 70.35 INR). But I received only ₹4483.45, almost 10% less.

When the transaction amount is high, your loss would be comparatively low. Still, you can expect to lose around 8-9% of the amount you receive.

Suggested read - What is UPI and how does it work?

How long do PayPal transactions take?

Although PayPal account transactions happen straight away, you don’t get the money in your bank account instantly.

Once someone sends you the payment, you get the notification within seconds. You can then transfer the amount to a local bank account linked with your PayPal account. If you don’t, PayPal will withdraw it automatically, the next day, to the bank account you selected for the auto-withdrawal facility.

PayPal will send the money to your account and the standard time taken is 3-5 days. But when I accept international payments there, in PayPal, I get the money within 24 hours of the withdrawal, most of the times.

And with that, I would conclude this article.

Should you use PayPal to accept international payments?

Now, should you get a PayPal account? Well, you now know the process to set up your account, the documents you require as well as the charges associated with the transactions. So, I would leave that decision to you.

Although PayPal charges are on the higher side, it’s safe, quick and trusted worldwide. So, it does have the edge over other options available to accept international payments.

Ponder over it and if you have other questions, shoot them in the comments.