Refrens – Free Freelancer Invoice Software (Quick Review)

First time when a client asked me to send an invoice, it took me a whole day to generate it. I had to hunt for a simple freelancer invoice template to customise. And then, I had to find what all should an invoice for freelancers have.

Turned out, invoicing is simpler than I thought.

But manually customising the Excel template every time has been a dreadful experience. It takes me about an hour to ensure the numbers and other details are correct. After generating the invoice, I also have to mail it. And you probably know how alert you must be while sending emails!

Then I came across Refrens. And I gave it a try.

At the time of writing, I used Refrens twice to send professional invoices to clients. And this article documents my first-hand experience with the available features.

What is Refrens?

Refrens is a little more than online invoicing software. The website intends to create a network for businesses and business service providers.

It’s like an online marketplace for freelancers. With Refrens, you can list your services and build a verified portfolio to showcase your work.

But I signed up only to generate simple invoices, and I liked its invoice management features.

After the initial setup, it takes only minutes (maybe 10-15) to add your first client and send the first invoice. Refrens saves your terms and conditions, which you can edit next time onwards.

How to invoice freelance work using Refrens?

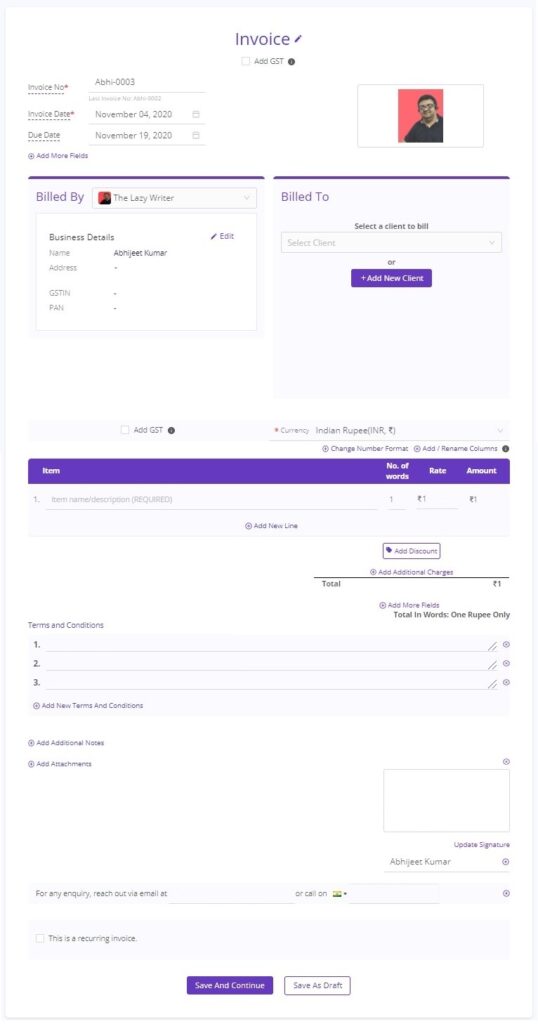

The online invoice generator of Refrens has pre-defined placeholders to input the details you need for your invoice. The software automatically numbers the invoices at the time of creation, and assigns a 15-day due date. Yes, you can change it.

Next, select the client from the list to invoice, or add a new client.

Afterwards, you can customise the rows and columns. Whether you want to generate a freelance hourly invoice or item-wise project invoice, you can add/remove/change the columns. Fill in the item description and the rates, and your invoice is ready.

And if you want to invoice for monthly retainer projects, mark it as a recurring invoice, and set the interval. Refrens will generate the invoices as per your set schedule.

You can add additional fields and other charges if you need. And you can also change the currency for invoicing on the fly. Add the terms and conditions, upload your signature and contact details, and save your invoice.

Refrens saves the details you entered. And they’ll be there when you want to generate your next invoice.

On the next screen, you get the options to add the payment details.

What are the various ways to get paid?

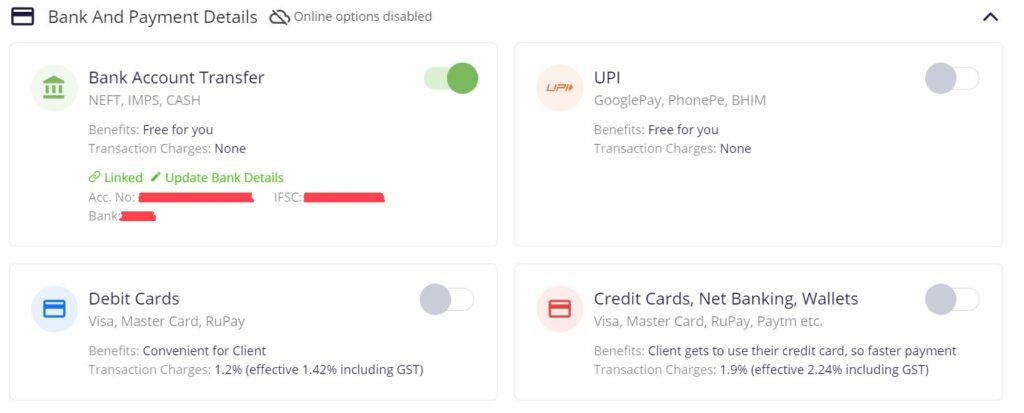

Once you finalise your invoice, you can now set up the payment methods.

Only bank account transfer method is enabled by default, and you have to enter your account details. It will show up in the invoice, and your client can transfer the amount directly to your account using NEFT or IMPS (or cash/cheque).

You can also enable other freelance invoice payment options visible on the screen for quicker payments. These allow the client to pay you directly using the payment gateway of Refrens. The client can use credit/debit cards, digital wallets or their UPI ID to pay you instantly.

Client gets the payment link along with the emailed invoice.

But, while bank account transfers cost nothing extra to you, being paid through Refrens payment gateway attracts transaction charges.

I enabled the online payment options for both the invoices I generated. But client cleared them through account transfers. So, for now, I won't comment anything on the transaction charges.

You can also receive international freelance payments via Refrens online payment gateway. But I am yet to check how cost-effective it is. I have been using PayPal to accept international payments until now.

Other features of Refrens

Refrens is like an online marketplace where businesses and service providers can find each other. Whether you’re a freelance accountant, developer or writer, you can list your portfolio and services.

You can connect with businesses, negotiate deals and send professional quotes. And when you want to send the invoice, you can generate it through the quote itself.

A bunch of free invoice template designs are also available. And you can customise them with a colour of your choice.

Refrens enables you to manage the invoices, and keep track of paid invoices and the pending ones. It also generates various reports to give you an overview of your income. And if you record your expenses, Refrens will generate your profit and loss report too.

Conclusion

I am yet to complete my profile and check all the features. But for now, Refrens seems to be an easy to use and reliable invoicing software for freelancers.

[click_to_tweet tweet=". @RefrensApp seems to be an easy to use and reliable invoicing software for freelancers. Check this quick review -" quote="Refrens seems to be an easy to use and reliable invoicing software for freelancers."]

You can create a freelance invoice template, send invoices to clients and get paid through secured payment links.

Refrens is free to use. And it charges you only when you get a client through Refrens or get paid through the payment gateway.

So, create your Refrens account [referral link], send invoices, and collect payments faster. If you sign up using my referral link, you'll get credit points, and so will I.

Subscribe to the Lazy Newsletter to get my updates.

And if you feel this post helped you today, you can send me a coffee… It’s up to you; you can choose not to.